Understanding Mortgage

Pre-Qualification VS Pre-Approval

If you are thinking about buying or selling a home on Cape Cod, there are two terms you have probably already heard a few times: pre-qualified and pre-approved. So, you might wonder exactly what these terms mean and how they may impact your home transaction?

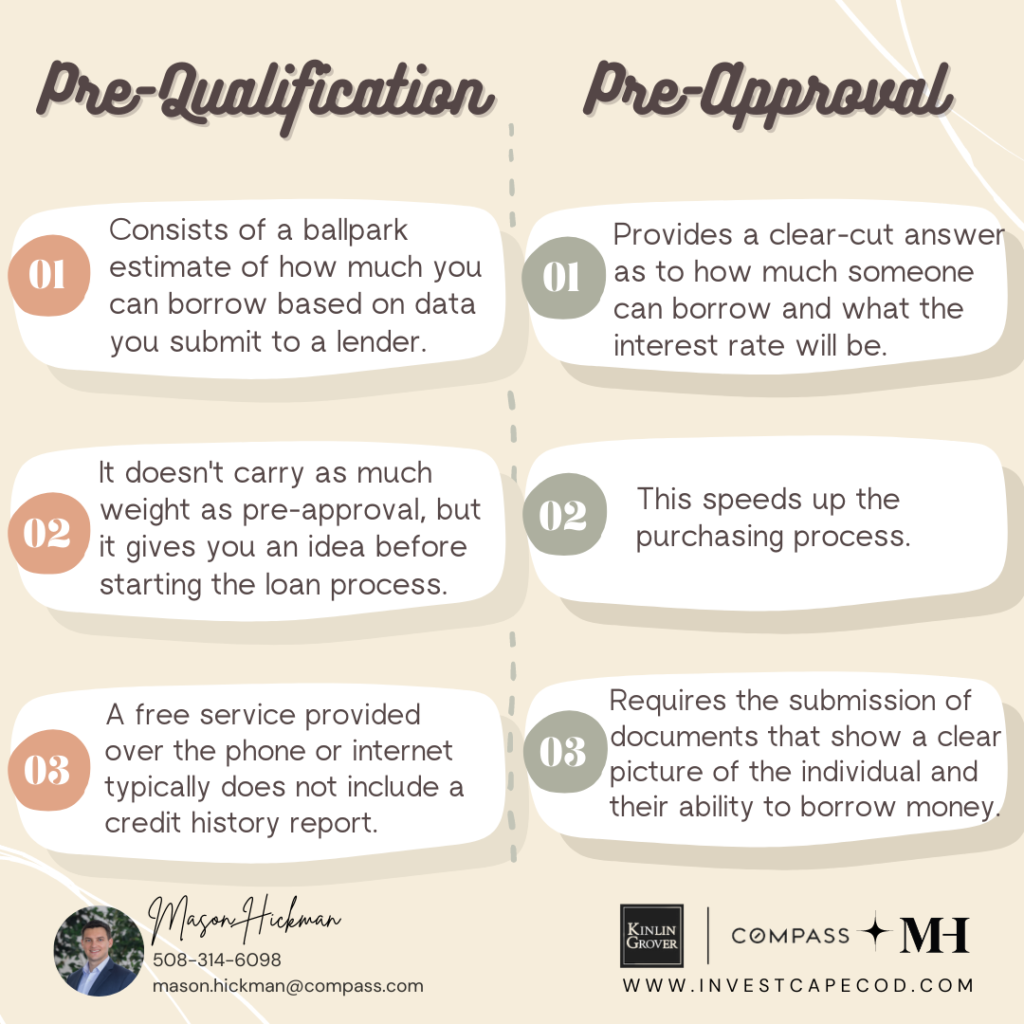

Homebuyers purchasing property often hear they will need a pre-qualification or pre-approval when going through the mortgage application process. These sound similar, but both serve different purposes during this vital process. A pre-qualification only estimates what size of a loan you may qualify for. A pre-approval is much more powerful and shows buyers you are even more serious. Conditional approval is even stronger and sets apart the most serious candidates and further vets their ability to close a loan.

Pre-Qualification

Getting pre-qualified for a mortgage generally means supplying your lender with basic verbal information about your financial situation – such as debt, income, and other major factors that will determine your eligibility for a loan. Your lender will review everything before giving you an estimate of how much money they’re willing to lend you for a Cape Cod home purchase. Pre-qualification is typically done over the phone or online and often doesn’t come with any cost attached. Keep in mind that it’s only a preliminary assessment; it doesn’t include an analysis of credit reports or a detailed examination of your ability to afford the houses you may be interested in purchasing.

The first step in qualifying for a mortgage is to discuss goals and needs with the lender. They can then review all available types of mortgages and determine which one would be most advantageous for you.

Pre-Approval

Getting pre-approved for a loan takes the lending process a step further than a pre-qualification. In order to get pre-approved for a mortgage loan, the applicant must fill out an official application and provide all of the requested written documentation (either in paper format or digitally) so that the lender can perform a thorough credit check. Once done with this step, the lender can approve you up to a certain limit, which will allow you to shop for a property.

There are many benefits to obtaining pre-approval from a lender before even looking for a home. For example, many lenders will offer applicants an estimate of the interest rate that would be charged if approved and/or allow you to lock in an interest rate before anything is set in stone. Additionally, some mortgage providers offer a conditional commitment in writing when you get pre-approved—allowing you to search within your budget range while shopping around for houses. When it comes time to make an offer on a home, the extra step of a conditional commitment will give you another advantage over other buyers who may not have gone through the same process. When you have a conditional commitment, oftentimes a lender can close on a shorter timeline, too!

Now that you know the difference, all you need to do is get set up with the local Cape Cod Realtor that can help you every step of the way in buying or selling your home! We have recommendations for local lenders, landscapers, contractors, and everyone in between! Contact us today at (508)314-6098.